Commited to finance

your projects abroad.

#Smartcapitalforbelgium

A Word from the CEO

to provide capital and know-how

"for international investments made

by belgian private sector companies."

In a globalized economy an increasing number of countries in Asia, the America’s, Africa and Central and Eastern Europe have been opening up their markets to foreign trade and investment; creating business opportunities for both local companies and Belgian enterprises wishing to enter or further penetrate those markets.

Today, the impact of changing economic policies in many countries, pandemics and the positive rise in the sustainability agenda raise

new challenges when it comes to taking strategic decisions on a company’s geographical deployment, whereby local investments remain however key. Choosing the right location with attention on geographical spread results in a more overall stable production and business environment for the Belgian investor.

After 50 years of existence, it is SFPIM International’s continued mission to support Belgian companies to optimize their presence abroad with adequate financing.

About

SFPIM International, founded in 1971, is a unique finance institution

with both public and private capital, active in the co-financing of business ventures by Belgian private companies abroad.

SFPIM International is a limited liability company, with more than 85% of its capital held by the Belgian State through SFPIM, a State owned investment fund.

The fact that SFPIM International is a government-related institution often benefits the project as it creates trust and enhances the confidence of foreign partners and/or authorities towards the Belgian private sponsored project.

SFPIM International offers tailor-made solutions taking into consideration the particular needs and risk profile of each individual project. As SFPIM International sets out to be a genuine long-term partner, it provides comprehensive support and advice as well as co-financing.

Since its creation, SFPIM International has invested in over 350 projects in more than 60 countries

References

“SFPIM International is the image that we would like Belgium to have in the world: stability, professionalism and pragmatism!”

“The interest in the content of the project and the broad vision on the further development possibilities is what makes SFPIM International a strong partner with an important added value in entrepreneurship.”

“SFPIM International is the right financial partner to develop our activities in Africa and to bring also a strong credibility towards our local partners.”

“While applying a shareholder’s approach in lending, SFPIM International successfully balances analytical thoroughness with pragmatism and speed of action and in this way they manage to act as a partner rather than a lender.”

Products

MEZZANINE FINANCING

SFPIM International offers a range of quasi-equity products. Commonly subordinated loans or profit participating loans are provided on the level of the foreign subsidiary, often combining a fixed interest rate with a profit-sharing aspect and, occasionally including conversion options. The term and grace periods are tailored to the specific needs of the project.

EQUITY

SFPIM International offers equity participations, on the level of the foreign entity in which case a majority equity holding by the Belgian company is required.

SFPIM International, with the support of its main shareholder, has access over € 100 million investment capacity. The amount of its contribution ranges between € 2 million and € 10 million, possibly higher via syndication with reputable partners. SFPIM International expects a matching contribution by the Belgian partner.

SFPIM International co-finances foreign projects of Belgian companies that have a relevant track-record and that want to expand the internationalization of their activities via a foreign investment.

The Belgian partner can be a dynamic SME, a medium-sized enterprise as well as a large corporate.

New projects (‘greenfields’), expansions of existing projects and acquisitions of existing companies abroad fall within the scope of co-financing by SFPIM International. All projects co-financed must show an overall favorable impact on the Belgian economy. The current portfolio of SFPIM International is highly diversified and reflects the most prominent sectors of the Belgian economy.

SFPIM International’s financial means can, in certain cases, be leveraged with considerable external financing capacities. SFPIM International has developed a close collaboration with the 3 regional investment companies (PMV, SRIW and SRIB) and also has good contacts with international and supranational institutions.

– World-wide in developed & developing countries

– More remote & challenging countries

– Countries under Sanctions and/or Embargoes are excluded

– Preliminary screening by SFPIM International to determine whether the project is eligible.

– Extensive analysis including: historical, financial and legal standing, due diligence of the Belgian company, information on its competitive advantages, business plan/forecasts for 3-5 years, management information, funding requirement and usage & financial structure of the proposed financing deal.

– The legal documentation: upon fulfillment of all conditions precedent the funds will be disbursed to the project.

– Follow-Up

Timeline from first contact to final approval: 3-4 months

Team

Board of directors

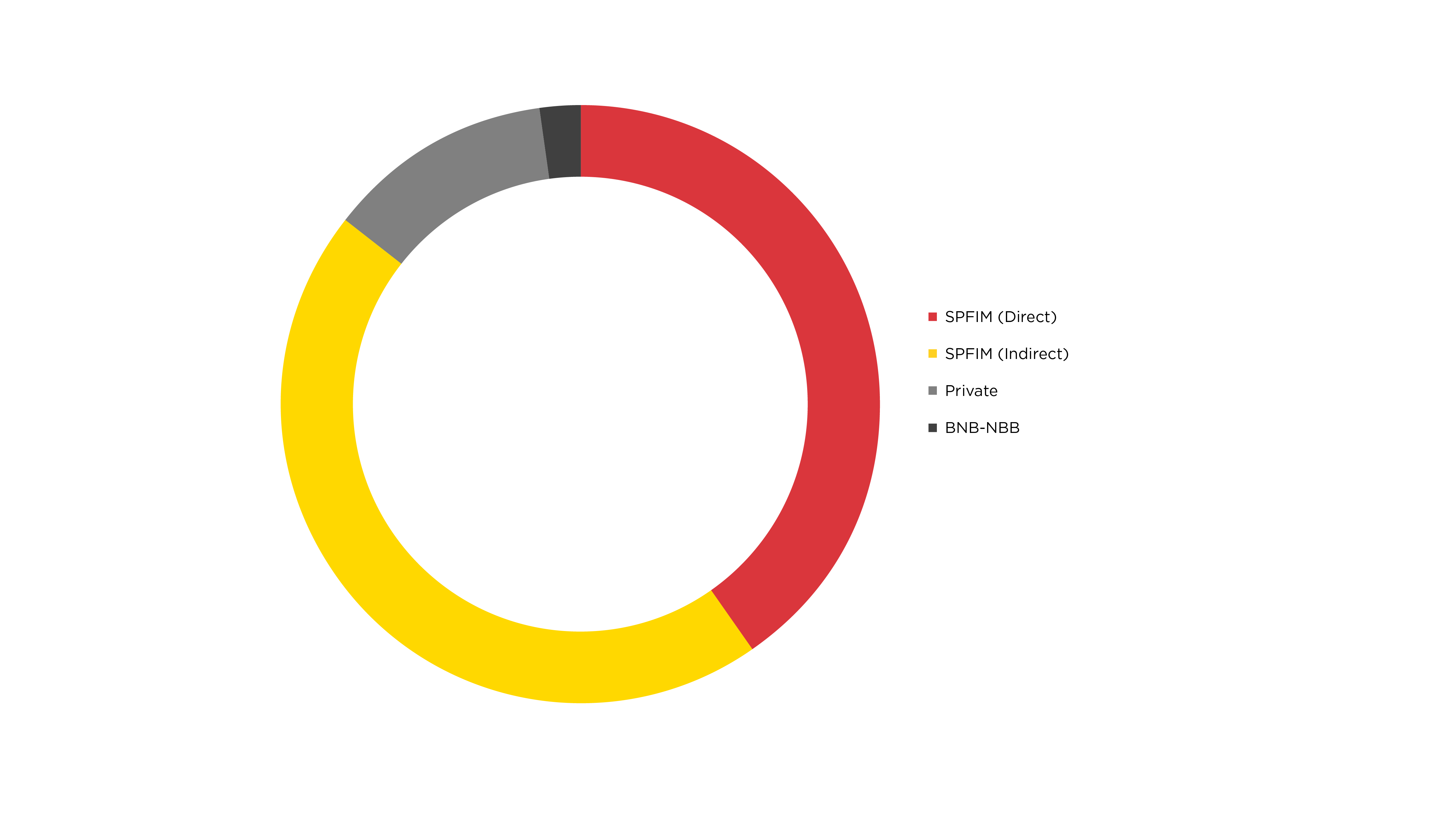

Capital structure

Public 87,75%

SFPIM

- Direct : 40,30%

- Indirect : 45,34%

BNB-NBB : 2,11%

Private 12,25%

Find all our news

on Linkedin

Find all our news

on Linkedin

Contact us.

SFPIM International

Avenue Louise – Louizalaan, 32 b13

1050 Bruxelles – Brussel